Aug22 Market Report – Abridged Vacation Report

Everyone is on vacation as am I. Shortened version this month with a market that oscillates in a range bound – let’s call it “August Vacation ” – mode. Or will it take advantage of the lack of liquidity to push the range? Thursday night it looks like it could break up. But, it would not surprise me if we close down on Friday.

Recommendations

As per the recent Jul22-Dec22 market poll we ought to sell at 250 and buy at 190. Given that, for now I’d look to sell the Dec190 put and buy the Dec 250/280 call spread at zero cost. Currently you would need a market of 210 vs Dec futures contract (12 cents lower than where the market is right now).

Market Poll

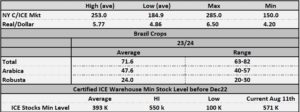

- Market poll conducted end of Jul/early August.

- Market range of 185 to 285 with an average of high of 253 and average low of 184.9.

- Very large range reflecting the uncertainty amongst participants: ie, everyone thinks it can break hard in either direction. This is also fits historical patterns where markets trade in a range (what it is doing) and then breaks decisively one way or the other.

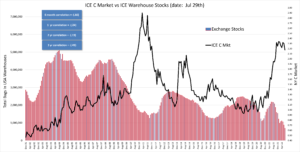

- ICE warehouse stocks on track towards average of participants ( 393 k ). Pending gradings adding some intrigue to current trend.

- Brazil 23/24 crop estimated at 71.6 mm bags.

- Good participation and even taking out some of the extreme numbers, averages do not change

Executive Summary – Technical Analysis

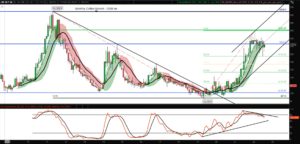

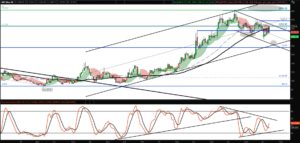

The market has been range bound for a few weeks now, but well contained below major moving averages (see weekly below). Thursday (today) was the first close above that MA in 4 weeks. If we are able to close above it tomorrow (Friday), there is a good chance we will see more upside shortly. If not, it’s a bit of coin toss, technically speaking. Fundamentally speaking, market still seems supportive. As per supply and demand below we ought to have a fairly tight market for the next few years.

Market Graphs (monthly, weekly, daily and 60 minute)

- Market broke through long term Moving Average and fell hard to 194, but then rebounded sharply giving the sense of a bear trap/V-shaped recovery.

- If we close above the long term moving average this week, this will be the first substantial confirmation in 4 weeks that the uptrend may be continuing.

- I would like to see consecutive closes above 225 to be more confident that another large move up is imminent.

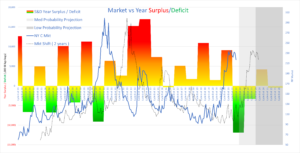

Supply and Demand

- I have dialed back a bit my Brazil 23/24 crop given the sense that others have also. Still early as nothing has even flowered, but I get the sense that is is more likely to be lower than 75, but higher than 70. Mkt poll expects 72.

- I like the 1st graph as it shows the delay between “known” fundamentals and market movement. Currently, it’s not totally clear, but both supportive both bull and bear/neutral arguments.

Supporting Graphs

(the following is much more detail than the average reader needs or wants)

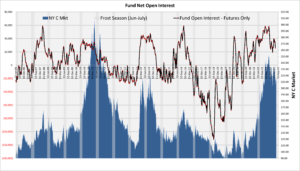

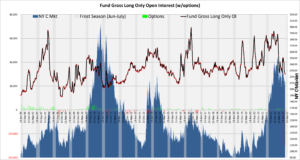

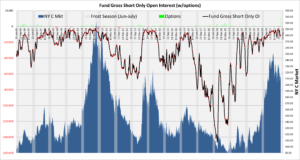

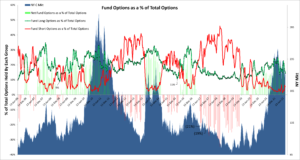

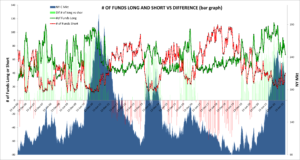

COT Open Interest

(all data derived from dissagregated futures only report)

COT Summary

- July was a blood bath for commodities and coffee was not able to withstand the onslaught.

Managed Money (MM)

- Funds still long and short funds not pushing the down side yet.

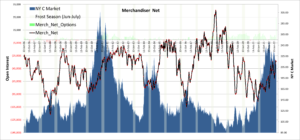

Commercials (Trade/Producers and Roasters)

- Roasters bought well on the sell off.

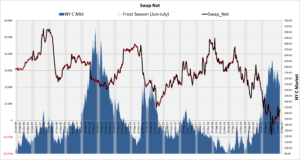

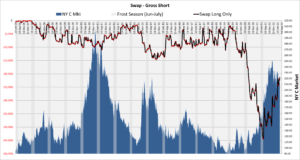

Swap

ICE Stocks

- Pendings are at 195 k adding a bit of intrigue and suspense to the current decline of ICE stocks

- ICE stocks at 571 K