Nov22 First Half Report

Summary

A combination of solid rains in Brazil (primary reason for decline), increased skepticism about consumption growth due to all the turmoil in Europe and to demand dampening measures adopted by the world’s central banks, and increased pending ICE warehouse stocks was enough to send the market down in one of the worst monthly performances in over a decade. October’s full range was 58.70 cents. We had a similar fall in September of 2011 when the market range was 62 cents. There was a bit of a pause in 2011 as the market rallied back towards the major moving averages, but eventually continued it’s descent. If the rains in Brazil do result in a record crop in Brazil for 23/24 in the realm of 76 to 80 mm, then it’s likely that we will see more downside over the next few months. The opening statement for the September Market Report was, ” Next 6 weeks ought to determine if we are at 150 or 350 by Spring. (hedging my bets: or maybe somewhere in between). Joking aside, Brazil rains (or lack there of) will determine next 40 to 100 cent move in either direction.” And that is what has happened: everything hinged on the potential for this crop.

As noted in the email, I am simplifying my reports going forward and thus the reason I did not publish a report in October as I worked on the format. As always I will continue with all the background analysis to come to my conclusions and will include some supporting graphs, but for the most part, most people are just interested in where I think the market will go and what I might recommend. The summary graphic below is where you will find that information.

I will also keep a running report card comparing the predictions vs what actually resulted in the market. Hopefully this will force me to be more diligent and help you decide whether to believe the conclusions or take with healthy grain of salt.

Recommendations

Since I do expect a bit of a counter trend rally bounce soon, I’d again play this with options erring on the side that the market is likely to trade lower over the next 6 months. Selling the March 150 put vs 190/220 call spread would provide some protection if the prediction proves wrong. If not, for most roasters, being long at 150 would seem like a miracle (at least 1 month ago). I have clients that postponed a lot of the forward purchases and opted for selling the March 170 put vs March 220/250 call spread. They are now “long” at 170, but with much reduced physical coverage; ie, they can now buy forward at a considerably lower market price and thus a win-win for them.

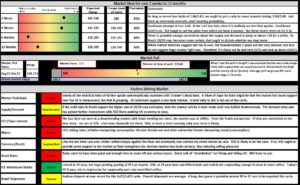

Summary Graphic

Summary graphic below:

- Shows best guesses for market over the next 2 weeks, 4 weeks, 6 months and 12 months out.

- The results of the Aug22-Dec22 poll and where we are in that range.

- Summary of factors supporting the best guesses

(note: ill be keep tabs of guesses vs. actual results in a permanent page on the website. That way one can gage how useful these reports have been)

Supporting Graphs

Supply and Demand

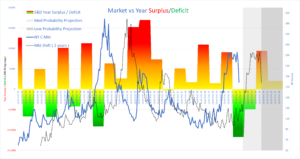

- If the Brazil rains now support a 23/24 crop in the 76/80 mm bags, then there is little hope for the market. Currently it seems the market is interpreting as such.

- Consistent rains through January will be necessary to support the higher end.

- First graph shows the World surplus/deficit vs the market with a 2 year lag. With Brazil rains solid through October, this supports a larger surplus.

Market

- Hard to recover from this change in technicals.

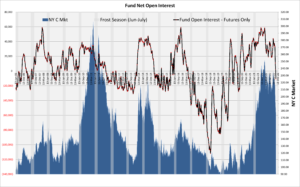

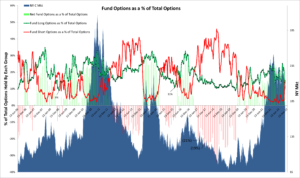

COT

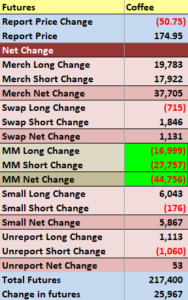

- Over last 5 weeks market fell 50 cents with funds selling a net of 44 k contracts.

- First time that the number of short funds has exceeded the number of long funds. This is a sticky metric that tends to support longer term moves in a similar direction.

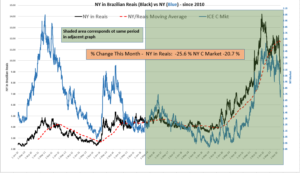

Brazilian Real

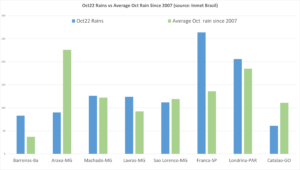

Brazil Rains

- Rains looked great in October

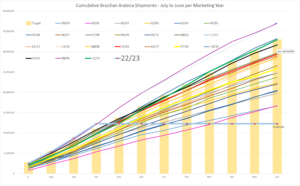

Brazil Shipments