Jul22 Market Report

7/5/22

- ICE Warehouse Stocks down nearly 100 k in 3 days (lowest in 20 + years).

- Sep22/Sep23 spread inverted around 12 cts. 2 Cold fronts pending in Brazil.

- Oh, and we still have rainy season with which to contend.

What am I missing?

- Macro/Demand/Brazilian Real? Maybe.

Recommendations

Same recommendation as always here.

- Preference to approach from the long side.

- With so much uncertainty, long call spreads vs selling the put. (I like the Sep 210 put vs the 250/280 call spread)

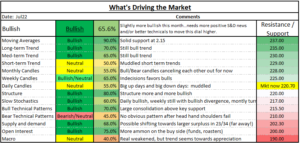

What’s Driving the Market

- Outside forces are a big driver over last few days (Oil down 10 % today)

- Roasters do not seem urgent to buy market/cover flat price.

- My weighted bias in graphic below still not solidly bullish (needs to be above 70).

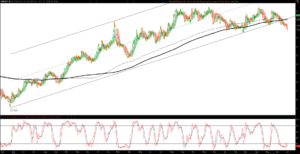

Executive Summary – Technical Analysis

Last month ended with bang as funds bought up the market to push it towards a positive month end close. The market then started Jul22 higher only to collapse 16 cents from the intraday highs. There seems to be a memo that I missed that said, “sell above 235”. I understand that the macro/demand picture is dubious right now and that larger roasters are not seeing the demand they had hoped for/anticipated. I do see it much stronger with small to medium sized roasters. But, we are still in the middle of Brazilian winter, the spread is inverted by 12 cents on a yearly basis and we are losing 30,000 bags a day of ICE Exchange coffee. That can’t keep up, but if it did, we’d be at zero bags by the end of July (for the record, I don’t think that).

Again, I think most of the emphasis is on what the potential for the Brazil 23/24 crop is. I am constantly reminded that the coffee is not even on the trees yet. But, still, if it truly is in the 76 to 80 mm range, then it’s hard to see how this market does not fall. Conversely, if it comes in closer to 68 mm bags (either due to weather or that’s where a large “off year” might be under best case scenarios), then I think that supports the bull narrative and aligns more with what the technical picture is telling me.

I am still a bull.

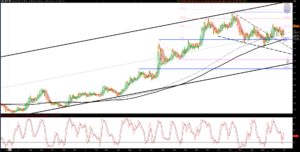

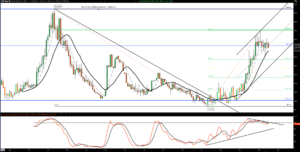

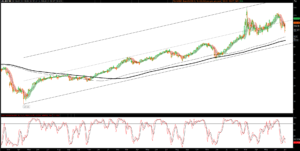

Market Graphs (monthly, weekly, daily and 60 minute)

- Volatile market that is stuck in a 215/220 to 235/240 range.

- Still solid technical support nearby.

- 215 Area should see lots of buying, if not tomorrow at 220 (if Oil holds its after market gains, coffee should be up tomorrow).

Other Commodities

Oil, Sugar and Soy

- You can see that over the last few days commodities have been decimated.

- Oil dropped by 10 % today alone. (up 2.5 % after hours right now)

Jan22-Jun22 Market Poll (Actual Results)

Below are the results form the poll conducted in Jan22. The beige section are the results from then and the blue is what actually happened (where it is known).

- Participants nailed the estimate for ICE Warehouse Stocks for end of Jun22. (within 10 k) Pretty impressive since this was conducted in Jan22.

- On the market high, we were off by 19 cents (we were aggressive in our view of how high we thought the market could go).

- On the market low, we also underestimated how far it could fall, but only 8 cents.

- Woefully off on how much the Brazilian Real could appreciated (one would have expected the NY ICE market to have rallied more on it)

- The Brazil crop results will not be “known” for a while, but market seems to have stuck with a 62/63 mm bags scenario.

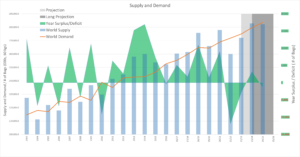

Supply and Demand

- Updated S&D shows a slight increase for Brazil 23/24 ( a long ways away ) since many are talking in the 7o to 76 mm bag range.

- I updated my S&D with USDA’s numbers in certain cases. Their consumption growth numbers do not match mine or many others. 2nd graph below is a matrix of all the different CAGR (compounded average growth) for coffee consumption over the years, depending on your starting point.

- I work with a rough 1.8 % CAGR, adjusting in real time.

- I like the results I get.

Supporting Graphs

(the following is much more detail than the average reader needs or wants)

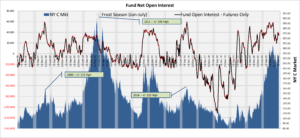

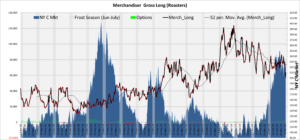

COT Open Interest

(all data derived from dissagregated futures only report)

- Market fell 13.8 cents during the 4 week period (Tues/Tues) and fund bought a net 1,120 contracts.

- Worrisome for the longs since it fell with such ease.

- But, there should be a lot of buying potential around 220/215

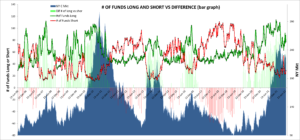

COT Summary

Managed Money (MM)

- With a 12 ct inverted Sep22/Sep23 market, not a lot of incentive to sell this market (as evidenced by Gross Fund/MM Short).

Commercials (Trade/Producers and Roasters)

- Roasters did add coverage into the previous week’s lows, but still likely undercovered unless they bought a lot over last few days.

Swap

- There should be some ammo here for buying.

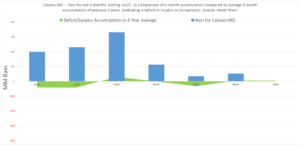

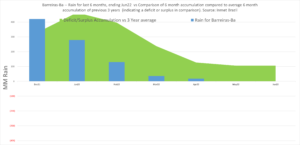

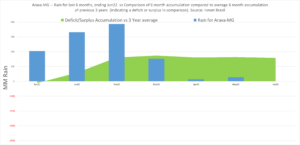

Rain in Brazil

Not a lot of rain in Brazil last month and less than previous year’s averages, but not such an issue yet.

The real issue is that most the rain accumulated over last 6 months was generated in Jan and Feb. As we enter the dry season, there will likely be a fairly large cumulative water deficit.

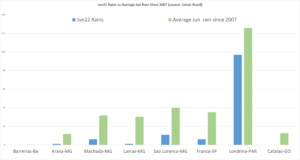

Month Rainfall vs. Historical Average (since 2007)

- Only Londrina got decent amounts (Parana)

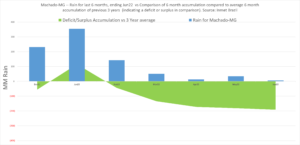

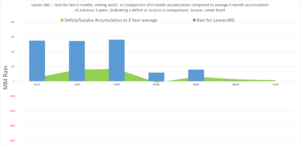

Cumulative 6 Month Rainfall vs Average Accumulation of Previous 3 years

- Lots and lots of rain in Jan/Feb…not so much lately (normal to below normal).

Brazilian Real/Dollar

- Real once again devalued sharply

- During the month, NY ICE market moved very little, but Real devalued 10 % (that is, 10 % more value to the producer without any move in NY ICE Mkt).

- With SELIC/FED rate likely to increase, I think there could be more capital directed toward Brazil: Real ought to appreciate.

ICE Warehouse Stocks

- 90 + K drop in 3 days (30 k today)

- Nearly below 800,000

- That should continue to drive strength in the spread.

Brazil Shipments

- Not a lot of surprises on Jul21/Jun22 shipment cycle. Likely to come in around 39 mm.

Currency – Dollar

- Dollar has potential to appreciate 10 % more against a basket of currency

Summary

Bullish macro and demand, should it materialize, ought to drive this market higher. Still a lot of uncertainty, but best to play from the long side.