Sep22 Market Report

9/6/22

Next 6 weeks ought to determine if we are at 150 or 350 by Spring. (hedging my bets: or maybe somewhere in between). Joking aside, Brazil rains (or lack there of) will determine next 40 to 100 cent move in either direction.

Recommendations

Given last months poll suggesting a similarly dramatic range of 190 to 250 and given what I think is an even higher likelihood of greater volatility, it would seem best to play this with options. As suggested last month, something along the lines of selling the 190 put and buying call spreads above 250. My bias is for the market to trade up with key support at 222/223.

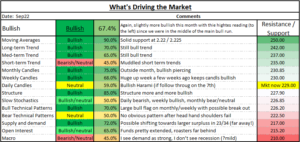

What’s Driving the Market

- The sum of all the factors I look at suggest an even higher bias this month for upside over the next few months. Huge rains obviously would squash that, but technically and fundamentally the market is supportive.

- I tend to get more confident when the indicator on the table is above 70. Currently it’s 67.4 (again, higher than in previous months).

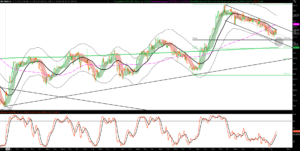

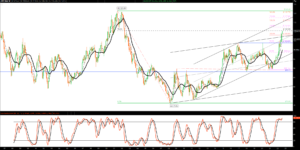

Executive Summary – Technical Analysis

The month of August saw a dramatic 28 cent move up in 3 days. We have since drifted back to the 50 % retracement of that move on small, volatile intraday moves (I don’t think i have seen so many days in succession that closed close to their open: ie, every day the market was looking for direction in either direction, but drifting down. Having bled off some of the overbought sentiment, given that roasters sold heavily into the move up and funds having likely lightened up a bit, the market seems likely to find some support nearby. Long term moving average support is around 223. When we finally broke that in July we traded below it for nearly 6 weeks until this last dramatic move up. Historically this would suggest resumption of the uptrend and likely support at that moving average. Given that it is only 5 cents below and the other factors mentioned above and in this report, the market ought to be be viewed as supportive here. Successive closes below that level, especially on a weekly basis, would negate that. Unless there is a hugely negative macro development, I am bullish here.

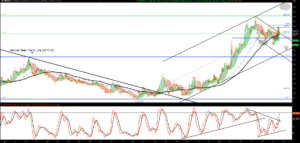

Market Graphs (monthly, weekly, daily and 60 minute)

- Both weekly and monthly charts are showing bullish flag patterns.

- The green/red shaded area on the weekly chart mute the impact of intra-week volatility. When we start trading within and above the green shaded area it is also indicative of more upside.

- A weekly close above 230 would go a long way to support the idea that we have broken to the upside with closes above 242 even more convincing.

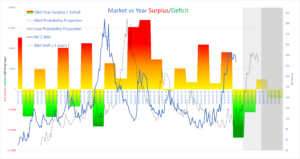

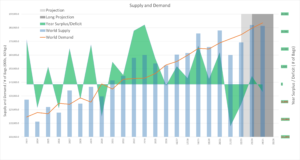

Supply and Demand

- I still see S&D as being very tight for next few years. While there may be a surplus for 23/24, it’s a bit early and it seems like many have dialed back a little their 23/24 production numbers for Brazil.

- Consumption: as an n of 1, I see demand as booming. I also do not believe much of the rhetoric around recession and partially buy the argument that inflation is transitory (depends on your definition of how much time “transitory” is. Inflation takes a bit of time to work out and and I think much of it is driven by supply chain train wrecks that will sort themselves out eventually).

Supporting Graphs

(the following is much more detail than the average reader needs or wants)

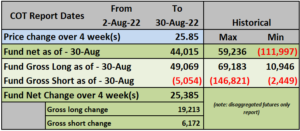

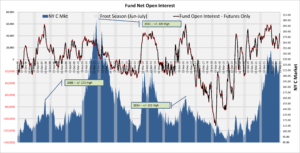

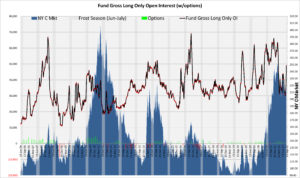

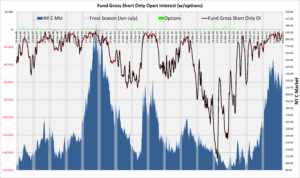

COT Open Interest

(all data derived from disaggregated futures only report)

Month data on COT shows funds having bought a net of 25,385 contracts moving the market 25.85 cents; a neat, 1 to 1 ratio that fits with historical, oft quoted ratios.

What is interesting is that that was nearly completely absorbed by the “roaster” side of the equation (see below summaries).

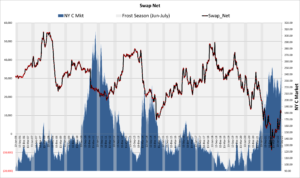

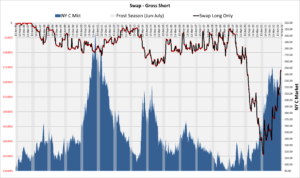

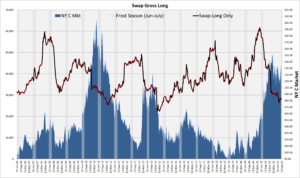

Again the gross short on the Swap side also bought heavily as they have for the last months bringing them closer to “a reasonable level”.

COT Summary

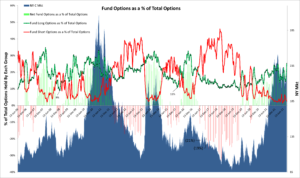

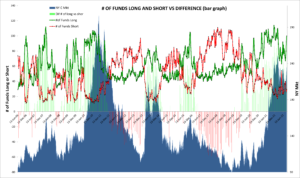

Managed Money (MM)

- Fund longs bought heavily.

- The # of funds trading on the long side spiked up quite a bit. This likely left some of them a bit exposed.

- % of funds long options also spiked with this rally.

- In general, an overall bullish bias on the funds side. Especially given the fact of how inverted the market is, it makes sense to be long.

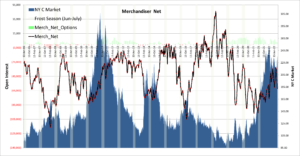

Commercials (Trade/Producers and Roasters)

- Roasters sold massively leaving them fairly exposed again; and well below trend, both moving average and general growth trend.

Swap

- Shorts buying back

- Net coming into more historical norms

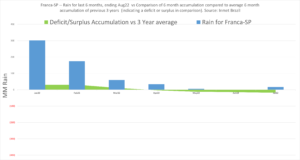

Rain in Brazil

The large amount of rainfall in Parana and to some extent São Paulo is potentially problematic is it might be too early to induce flowering. But it also looks like they may get the follow up needed. Net, I’d say not the best set up for bears. Some flowering in Sul de Minas might be lost. Too early to speculate too much about this.

The expectation of a La Niña year poses some threat of drought conditions. The latest that I read that is expected to be more mild, but real.

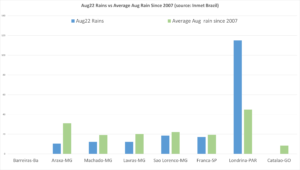

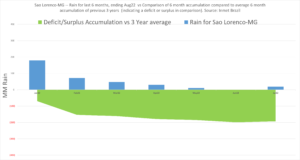

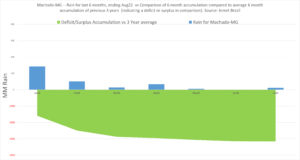

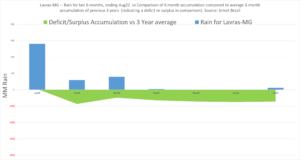

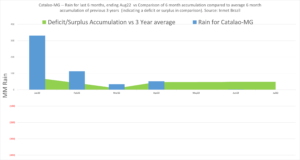

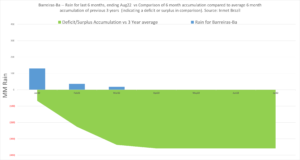

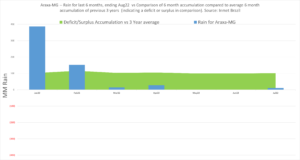

Cumulative Month Rainfall vs. Historical Average (since 2007)

- Generally just below average rainfall for most of the region except Parana and São Paulo.

- Low rainfall in August is often required for a better crop; needed stress (hormesis).

Cumulative 6 Month Rainfall vs Average Accumulation of Previous 3 years

- Cumulative rainfall over last 6 months suggests some vulnerability.

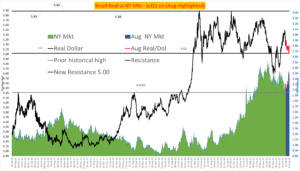

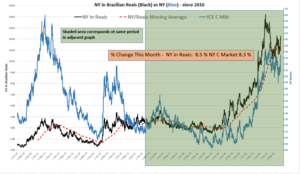

Brazilian Real/Dollar

- Despite the big move up in ICE Market, Real did change. Farmers were therefor able to get the full value of the ICE market move up.

- Sep has already started with a very strong dollar as seen in dollar index below. As mentioned in previous months, dollar looks like it could gain another 5 to 10 %.

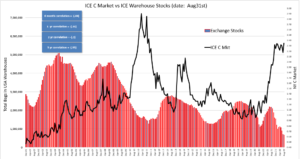

ICE Warehouse Stocks

- Despite all the recertified/pendings that had piled up, ICE Stocks fell again on a month to month basis.

- I do not see more pendings coming on in the near term. That should continue to support the inverted switch.

- One theory I have about the 250 k or so pendings that showed up last month. I think it’s likely that those coffees were already sold to roaster. Either the trade company worked out with the roaster that they could recertify the past crop as part of the deal to get the sale or the trade company simply factored that into their sales strategy: coffee was sold, why not try and get a few extra cents in the process.

Brazil Shipments

- Jul and August shipments are right in the middle of previous years; not much to extrapolate from yet.

- Arabica shipments however were very high.

Summary

Key technical support around 223 with the potential for large market moves depending on Brazil rain.